I401k contribution calculator

An employer may match up to 3 of. Get a Diversified Portfolio for your Retirement Goalsin One Simple Investment.

How Much Can I Contribute To My Self Employed 401k Plan

It provides you with two important advantages.

. Use this calculator to see how increasing your contributions to a 401 k 403 b or 457 plan can affect your paycheck as well as your retirement savings. A 401k can be one of your best tools for creating a secure retirement. A retirement calculator is a simple way to estimate how your money will grow between now and the time you retire if you continue investing at the rate you are today.

Step 3 Now determine the duration which is left from current age till the age of. Penelope makes it simple. 401k and Roth contribution calculator.

Ad An Edward Jones Financial Advisor Can Partner Through Lifes MomentsGet Started Today. Use this contribution calculator to help you determine how much you will have saved in your 401k fund when you retire. A Solo 401 k.

10 Best Companies to Rollover Your 401K into a Gold IRA. Hopefully you have more than this saved for. This calculator has been updated to.

Solo 401k Contribution Calculator. This federal 401k calculator helps you plan for the future. According to research from Transamerica this is the median age at which Americans retire.

Current 401 k Balance. Ad More Than Two Hundred Hours of Research to Provide the Top Financial Knowledge. The 401 k Calculator can estimate a 401 k balance at retirement as well as distributions in retirement based on income contribution percentage age salary increase and investment.

A 401 k can be one of your best tools for creating a secure retirement. Calculate your retirement earnings and more. Free calculators that help with retirement planning with inflation social security life expectancy and many more factors being taken into account.

It provides you with two important advantages. Using the Calculator to Estimate Your Future Earnings. Titans 401 k calculator gives anyone the ability to project potential returns from a 401 k retirement fund based on your current age 401 k balance and annual salary.

Visit The Official Edward Jones Site. Ad Understand The Impact Of Taking A Loan From Your Employer Sponsored Retirement Account. Your 401k plan account might be your best tool for creating a secure retirement.

NerdWallets 401 k retirement calculator estimates what your 401 k. With Merrill Explore 7 Priorities That May Matter Most To You. Solo 401 k Contribution Calculator.

Strong Retirement Benefits Help You Attract Retain Talent. Protect Yourself From Inflation. If your business is an S-corp C-corp or LLC taxed as such.

First all contributions and. Ad Attract and keep employees with 401k plans. Use this calculator to see how much more you could accumulate in your employer retirement plan over time by increasing the amount that you contribute from each paycheck.

First all contributions and earnings to your 401k are tax-deferred. With this 401 k contribution calculator you can estimate what you will have saved in your fund when you plan to retire. Ad What Are Your Priorities.

A 401 k account is an easy and effective way to save and earn tax deferred dollars for retirement. Ad A One-Stop Option That Fits Your Retirement Timeline. Ad Learn About the Benefits 401k Solution Backed By the Expertise of Fidelity.

With Merrill Explore 7 Priorities That May Matter Most To You. Ad What Are Your Priorities. If youve thought for even a few minutes about saving for retirement chances are you have some familiarity with the 401k savings plan.

Self-employed individuals and businesses employing only the owner partners and spouses have several options for tax-advantaged savings. Ad If you have a 500000 portfolio download your free copy of this guide now. You probably know for example.

New Look At Your Financial Strategy. Step 2 Figure out the rate of interest that would be earned on the 401 Contribution. Definition of a 401k Account.

Impact on retirement fund balances Beneficiary required minimum distribution. You only pay taxes on contributions and. Our subscription-based plans are just 8 per employee per month.

Join 33M Users Taking Advantage Of Personal Capitals Financial Tools As Of 53122. Please note that this calculator is only intended for sole proprietors or LLCs taxed as such.

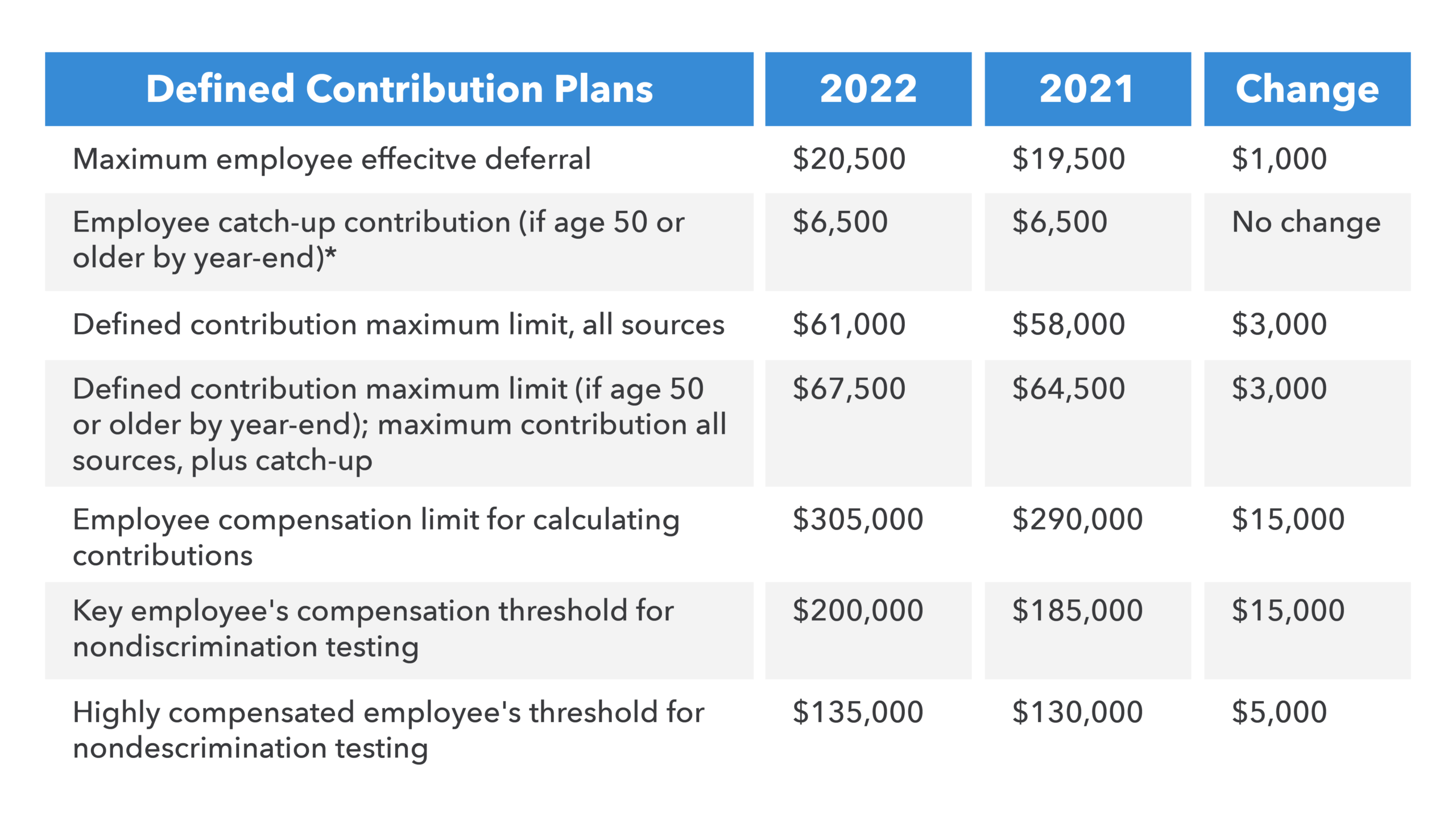

Solo 401k Contribution Limits And Types

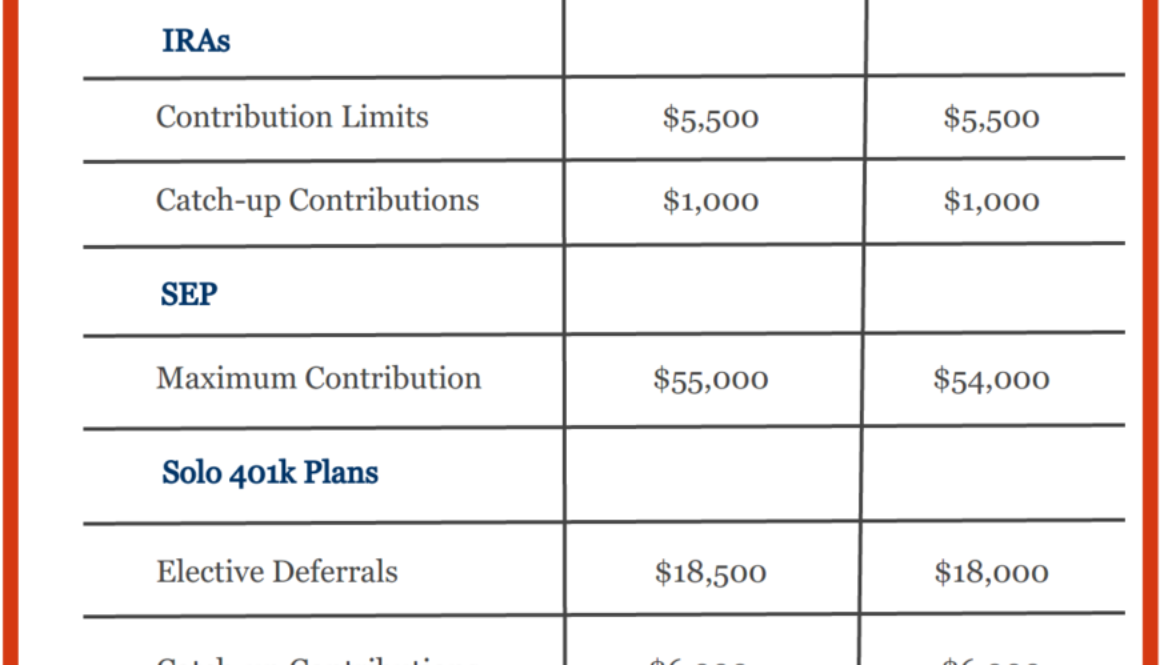

How Much Can I Contribute To My Self Employed 401k Plan

How To Calculate Solo 401 K Contribution Limits

Solo 401k Contribution Limits And Types

Solo 401k Contribution For Partnership And Compensation

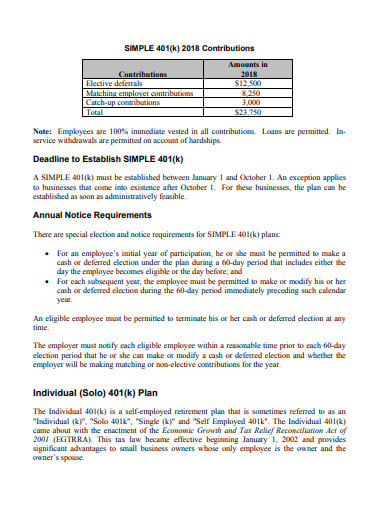

Solo 401k Rules Solo 401 K Small Business

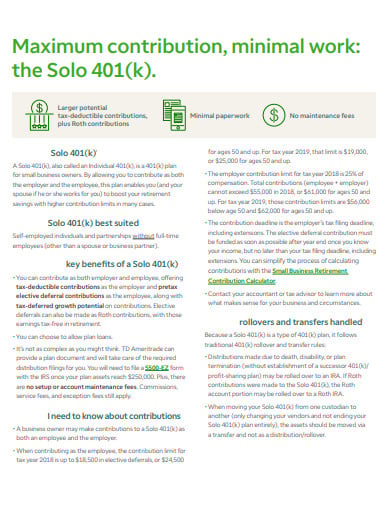

The Solo 401 K Moneywise Guys

9 Self Employed 401k Calculator Templates In Pdf Free Premium Templates

Solo 401k Contribution Calculator Solo 401k

Solo 401k Contribution Limits And Types

9 Self Employed 401k Calculator Templates In Pdf Free Premium Templates

Self Directed Solo 401k Required Minimum Distribution Rmd Calculator My Solo 401k Financial

Solo 401k Contribution Limits And Types

Solo 401k Contribution Limits And Types

2

How Much Can I Contribute To My Self Employed 401k Plan

Solo 401k Contribution Calculator Solo 401k